The Story of The Fort Jennings State Bank

Leo J Wildenhaus was a teacher at Fort Jennings High School in Fort Jennings, Ohio, when he decided to pursue a career as a banker. He began working at a Coldwater Bank to learn the trade. In 1915 he started a bank in Darke County, Ohio, which was named Osgood State Bank, which remains in existence today. The merchants and farmers of the southwestern portion of Putnam County asked Leo to return to Fort Jennings. He did and in 1918 he helped to organize and open The Fort Jennings State Bank. Leo served as the bank’s first cashier, holding that position until 1958.

R.J. ‘Banker Bill’ Wildenhaus started at the bank in 1954 and served as cashier from 1958 to 1983. During that time the bank continued its success and by 1970 it became apparent that new facilities would be required to serve its growing customer base. The bank was originally located in what is now the U.S. Post Office in Fort Jennings. In 1970 a new building was constructed across the street and to the north of the previous bank and included one of the very first drive-up teller windows in the area. In 1988, an Automated Teller Machine (ATM) was installed, allowing customers access to their checking and savings accounts 24 hours a day, 7 days a week.

By 1990, continued growth led the bank to construct an addition that nearly doubled the size of the bank building. History lines the walls with old pictures of the Village of Fort Jennings and the surrounding area exhibited. The old was mixed with the new as the vault door from the original bank building was reclaimed, its wheel and tumblers still operational. The front side of the vault was attached to the wall of the new Boardroom, while the remainder became a part of the Boardroom conference table. President Larry Schimmoeller stated:

“We are very proud to be able to have a piece of the old bank with the new. The bank, along with this area, has come far to be where it is at today. Our ancestors worked very hard to drain the (Black) Swamp, building their homes and the Village, and starting their businesses. Some of those businesses are still in existence. We hope that this little piece of history will remind us of the legacy that our forefathers left.”

In 1993, it again became apparent that the physical location was too small to serve its customers effectively and rather than expand the Fort Jennings facility again, it was decided to construct a branch office in nearby Ottoville, Ohio. Using as many local contractors and vendors as possible, the brand new building was completed and a Grand Opening held in late 1994. History abounds with pictures of Ottoville as it used to be, mixed with the very latest in bank design.

In late 1995, a new opportunity was presented to the bank. A large commercial bank was divesting some of its bank branches located in smaller communities and by March 1996, a branch office in Columbus Grove, Ohio had been purchased by the bank, adding a new customer base to whom the banks products and services could be offered. This building was also decorated with historical pictures of the Columbus Grove area and received some modernizing of its appearance with new landscaping designed by an area landscape designer, and interior design help from a local shopkeeper/decorator. In late 2002 the Board of Directors made the decision to raze the Columbus Grove building and construct a new facility with a design similar to other bank offices. In June 2003 a temporary facility was opened nearby, allowing the office to relocate and remain in operation during the construction process and in February 2004 the new office was completed and opened, with a Grand Opening held shortly after.

In late 2000, the Board of Directors commissioned a study to determine the feasibility of a branch in the village of Leipsic, Ohio, which is located in the northeastern section of Putnam County. In April of 2001, a temporary facility was opened for business, with construction of an all-new branch office commencing shortly thereafter, once again using local contractors wherever possible. This new office was completed by the end of 2001 and a Grand Opening celebration held in early 2002. This office uses the same design as other FJSB offices and also displays pictures of Leipsic from the past.

Continuing a process of evaluating potential opportunities to serve customer, in October 2005 a temporary banking facility was opened in Ottawa, the Putnam County seat, followed by construction of a permanent office, once again using local contractors wherever possible. This new office was completed by the end of 2006 and a Grand Opening celebration held. This office uses the same design as other FJSB offices and also displays pictures of Ottawa from the past.

With the addition of 4 branch offices and the overall growth experienced by the bank since the remodeling of the Fort Jennings office in 1990, the realization took hold that additional facilities and space were needed to effectively service the bank's customers. In spring 2012, construction began on a new 6,000 square foot main office. A Grand Opening of this modern banking facility was held in late 2013.

In 1997, an important step was taken to help the bank remain an independent, community bank. From its inception in 1918, the bank had been owned by its stockholders. In December 1997, a holding company, FJSB Bancshares, Inc, was formed, with The Fort Jennings State Bank as its wholly owned subsidiary. The stockholders of The Fort Jennings State Bank became the stockholders of FJSB Bancshares, Inc.

As the millenium dawned, the bank adopted a formal mission statement:

The purpose of The Fort Jennings State Bank is to become the bank of choice in the communities we serve. We will accomplish this by offering to our customers the financial services they expect while providing a return to our owners. In accomplishing this mission, we will remain an independent community bank.

The purpose of the mission statement is to help all employees, stockholders and customers realize the purpose of the bank’s existence. In addition, a new motto “the Bank of choice” was implemented.

In 2018, the bank observed its 100th anniversary. While larger and more diverse than in its first years of operation, The Fort Jennings State Bank has never forgotten the customers who have made the institution successful. The Fort Jennings State Bank is proud that it remains an independently owned, community bank dedicated to serving those customers.

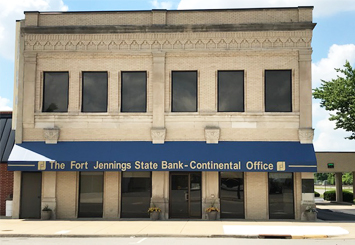

In late 2018, another opportunity was presented as a large commercial bank announced the closure of offices in smaller communities. After deliberation, The Fort Jennings State Bank announced its intent to open a branch in Continental, Ohio. In February 2019 a temporary banking facility was opened in order to establish a presence and service customers and, in April 2020 the branch was moved to its permanent office in a historic building located in downtown Continental.

In mid-2021, yet another opportunity was presented as a large commercial bank had closed an office in Glandorf, Ohio, leaving the community with no banking services provider. The Fort Jennings State Bank purchased the building where the former bank was located and, after extensive renovations, opened in July 2022.

As of December 2025, The Fort Jennings State Bank has assets of over $274.0 million and 46 employees.